Break-even (B/E) analysis is a simple, but very effective financial feasibility test. B/E is used to determine the amount of sales necessary to pay all fixed costs (and have zero profit). Follow these steps:

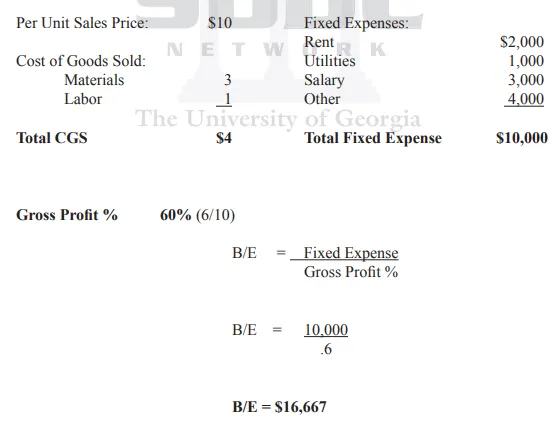

1. Determine Gross Profit Percent. Gross profit equals sales minus cost of goods sold. Gross profit percent equals gross profit dollars divided by sales. Note: Cost of Goods Sold (CGS) is a variable expense, including materials and labor necessary to make an item ready for sale. If a business (like consulting) has no CGS, then gross profit percent is 100 percent.

2. List and Total all Fixed Expenses. Expenses which do not rise or fall with sales volume – rent, insurance, utilities, etc.

3. Break Even Sales is Fixed Expenses divided by Gross Profit Percent. (See example below.)